Understanding Bitcoin Technology is more than a digital currency — it’s a technological revolution that relies on blockchain, consensus algorithms, and cryptography to operate securely without intermediaries. For beginners and even experienced investors, understanding the technology behind Bitcoin is essential to appreciate its value and trustworthiness.

From my experience guiding crypto enthusiasts, the core strength of Bitcoin lies in its decentralized network, immutability, and cryptographic security. In 2025, as Bitcoin adoption grows, these technological fundamentals remain the backbone of its success.

In this guide, we’ll break down how Bitcoin’s blockchain works, explain the Proof of Work consensus mechanism, examine its security features, and clarify why Bitcoin continues to be the most secure and trusted cryptocurrency in the world.

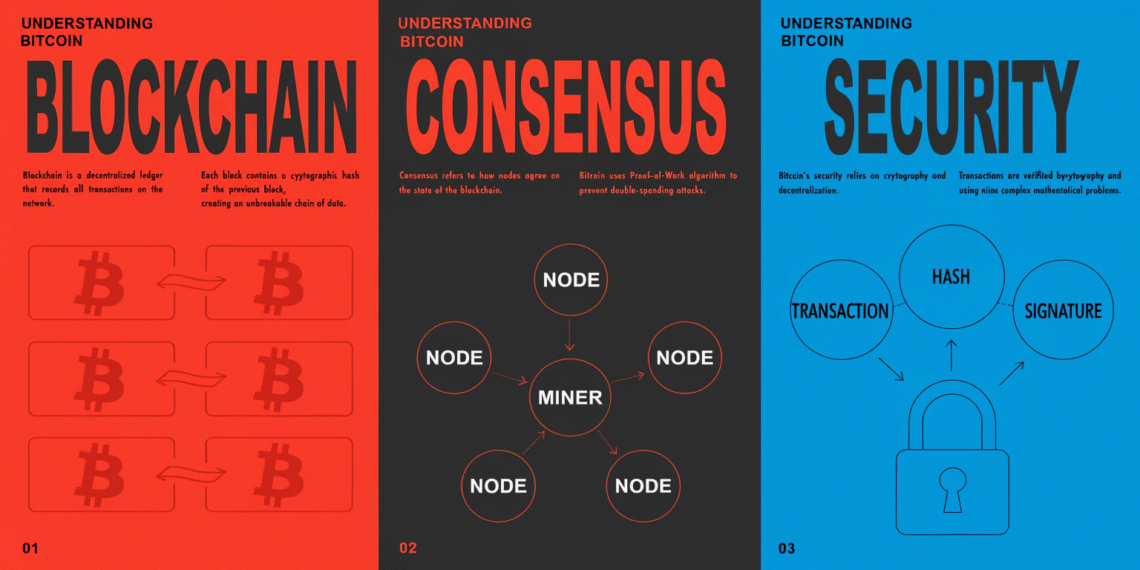

What Is the Bitcoin Blockchain?

The Bitcoin blockchain is a public, decentralized ledger that records all transactions securely. Key features:

Decentralized: No central authority controls it

Immutable: Transactions cannot be altered once confirmed

Transparent: Anyone can view transaction history

Pro Tip: Every Bitcoin transaction is recorded in blocks, linked chronologically, forming the blockchain.

How Bitcoin Transactions Work

1. Transaction Initiation

User creates a transaction with sender, receiver, and BTC amount

Transaction is broadcast to the Bitcoin network

2. Verification by Miners

Miners validate transactions using cryptographic proofs

Verified transactions are grouped into a block

3. Adding Blocks to the Chain

Miners solve a complex mathematical puzzle (Proof of Work)

First miner to solve it adds the block and earns rewards

Block is timestamped and linked to the previous block

Investor Insight: This process ensures all transactions are secure, verified, and tamper-proof.

Proof of Work Consensus Explained

What Is Proof of Work (PoW)?

PoW is the mechanism that secures the Bitcoin network:

Miners compete to solve cryptographic puzzles

Requires significant computational power

Ensures network security and prevents double-spending

Why PoW Matters

Makes Bitcoin decentralized and trustless

Prevents malicious actors from altering the blockchain

Rewards miners for securing the network

Mini-case study: Even with rising hash rates in 2025, the PoW system remains resilient against attacks.

Bitcoin Network Security Features

1. Cryptographic Hashing

SHA-256 algorithm secures transactions and blocks

Each block has a unique hash; altering data changes the hash, revealing tampering

2. Decentralization

Thousands of nodes globally verify transactions

No single point of failure or control

3. Immutability

Once a block is added, it cannot be modified

Ensures trust and transparency

4. Incentives for Miners

Block rewards and transaction fees motivate miners to act honestly

Economic incentives prevent malicious attacks

Advantages of Bitcoin Technology

Security: Resistant to hacks and fraud

Transparency: All transactions publicly recorded

Decentralization: No central authority can manipulate the system

Scarcity: Fixed supply of 21 million BTC ensures value over time

Global Accessibility: Anyone with internet can participate

Investor Insight: These features make Bitcoin a secure store of value and digital gold in 2025.

Common Misconceptions

Bitcoin is anonymous: It’s pseudonymous; transactions are traceable

PoW wastes energy: Energy secures the network and is increasingly sourced from renewables

Blockchain is slow: Bitcoin prioritizes security over speed; Layer 2 solutions improve scalability

FAQs

Q1: What makes Bitcoin secure?

A: Bitcoin’s security comes from decentralization, cryptography, Proof of Work, and network incentives.

Q2: How does the blockchain work?

A: Transactions are grouped into blocks, verified by miners, and linked in a chronological, immutable chain.

Q3: What is Proof of Work?

A: PoW is a consensus mechanism where miners solve complex puzzles to validate transactions and secure the network.

Q4: Can Bitcoin be hacked?

A: The network itself is extremely secure due to decentralization and cryptographic protections, though individual wallets can be targeted.

Q5: How many Bitcoins will exist?

A: Bitcoin has a fixed supply of 21 million coins.

Q6: Is Bitcoin truly decentralized?

A: Yes, thousands of nodes worldwide validate transactions without a central authority.

Internal Links

Bitcoin for Beginners: How to Buy, Store & Use BTC in 2025

Bitcoin Wallet Setup Guide: Hot vs Cold Wallets Explained

How to Trade Bitcoin Safely: Tips for Beginners