INTRODUCTION

Decentralized finance (DeFi) has transformed the crypto landscape, offering financial services like lending, borrowing, staking, and yield farming without intermediaries. In 2025, DeFi continues to grow, with innovative projects launching new protocols, platforms, and token incentives.

From my personal experience tracking DeFi markets, tokens tied to strong ecosystems, utility, and active communities have consistently outperformed during altcoin seasons. However, identifying the right DeFi tokens requires careful evaluation of fundamentals, adoption, and tokenomics.

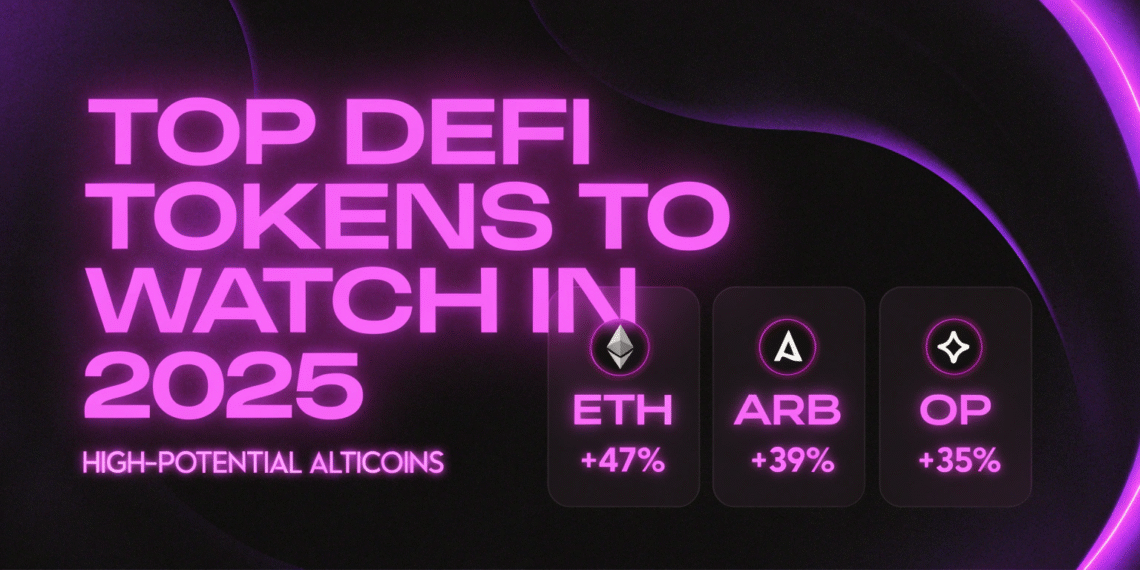

This guide highlights the top DeFi tokens to watch in 2025, explains why they matter, and offers actionable strategies for investors. Whether you’re a long-term holder or seeking early-stage opportunities, understanding these DeFi tokens can help you navigate the next wave of crypto growth.

What Makes a DeFi Token Valuable?

A valuable DeFi token combines utility, adoption, liquidity, and strong governance. Key factors include:

Use Case: Lending, borrowing, trading, or staking

Liquidity & TVL: High Total Value Locked indicates adoption

Tokenomics: Staking incentives, burn mechanisms, and governance rights

Community Engagement: Active users drive growth

Pro Tip: Tokens with real-world utility and protocol adoption tend to outperform hype-driven projects.

Top DeFi Tokens to Watch in 2025

1. Aave (AAVE) — Leading Lending & Borrowing Protocol

Core Value: Allows users to lend and borrow crypto assets efficiently

Tokenomics: Staking rewards and governance rights

Adoption: Millions of users across multiple chains

Mini-case study: Aave’s cross-chain adoption via Polygon and Avalanche increased its Total Value Locked (TVL) significantly in 2024, showing sustained growth potential for 2025.

2. Uniswap (UNI) — Decentralized Exchange Pioneer

Core Value: Facilitates token swaps without intermediaries

Tokenomics: Governance token, staking incentives

Adoption: One of the largest decentralized exchanges globally

Investor Tip: UNI holders can vote on protocol upgrades, influencing fees, rewards, and liquidity pools — giving long-term holders strategic advantages.

3. Curve DAO Token (CRV) — Stablecoin AMM

Core Value: Optimized Automated Market Maker for stablecoins

Tokenomics: Incentivizes liquidity providers with staking rewards

Adoption: Core protocol for stablecoin swaps across DeFi

Tip: CRV tokens are highly leveraged in yield farming strategies, making them attractive for both long-term holders and active DeFi participants.

4. Maker (MKR) — Governance for Stablecoin DAI

Core Value: Decentralized governance for DAI stablecoin

Tokenomics: MKR holders vote on system parameters

Adoption: Essential for the DAI ecosystem and DeFi lending

Investor Insight: MKR’s value correlates with DAI adoption, protocol health, and governance participation, making it a long-term DeFi play.

5. SushiSwap (SUSHI) — Multi-Chain DeFi Hub

Core Value: AMM platform with lending, yield farming, and staking

Tokenomics: Community-driven governance token

Adoption: Expanding into cross-chain liquidity solutions

Mini-case study: SushiSwap’s integration with Layer 2s like Arbitrum and Optimism has enhanced user adoption and reduced fees, positioning it well for 2025.

How to Evaluate DeFi Tokens for Investment

Step 1 — Check Total Value Locked (TVL)

High TVL indicates adoption, liquidity, and trust in the protocol.

Step 2 — Analyze Tokenomics

Assess staking rewards, burn mechanisms, governance rights, and supply allocation.

Step 3 — Study Community Engagement

Active Discord, Telegram, and social media engagement signals organic growth potential.

Step 4 — Research Partnerships & Integrations

Cross-chain compatibility, integrations with lending platforms, and collaborations with other protocols drive adoption.

Step 5 — Monitor Market Cycles

Track altcoin season indicators, BTC dominance, and DeFi growth trends to time your investments strategically.

Common Mistakes to Avoid in DeFi Investing

Ignoring impermanent loss in liquidity pools

Investing in low-TVL or unaudited protocols

Over-leveraging with margin or lending

Blindly following hype without research

Holding tokens on exchanges without securing them in wallets

FAQs

Q1: What is a DeFi token?

A: A DeFi token represents access, governance, or utility within a decentralized finance protocol.

Q2: Why invest in DeFi tokens?

A: They provide exposure to decentralized lending, borrowing, staking, and trading ecosystems with high growth potential.

Q3: How do I evaluate DeFi tokens?

A: Check Total Value Locked (TVL), tokenomics, adoption, governance, and community activity.

Q4: Are DeFi tokens risky?

A: Yes, they carry smart contract, liquidity, and market risks. Diversify and invest responsibly.

Q5: Which DeFi tokens have the most long-term potential?

A: AAVE, UNI, CRV, MKR, and SUSHI are among the top tokens based on adoption, utility, and governance.

Q6: Can DeFi tokens outperform Bitcoin?

A: During altcoin seasons, high-quality DeFi tokens can outperform BTC in short- to medium-term growth.

Internal Links

Best Altcoins for Long-Term Investment in 2025

New Crypto Projects With Massive Potential in 2025

Tokenomics Explained for Beginners

Undervalued Altcoins to Buy Now