Introduction

Cryptocurrency continues to evolve at lightning speed, reshaping finance, technology, and global markets. As we move into 2025, staying informed about emerging trends, regulatory changes, and innovative blockchain solutions is crucial for investors, traders, and enthusiasts.

From my experience tracking crypto markets, understanding trends is not just about spotting profitable coins — it’s about recognizing technological advancements, DeFi growth, NFT innovations, and market dynamics that will define the next phase of digital finance.

In this guide, we’ll explore the most important cryptocurrency trends for 2025, including market predictions, emerging altcoins, the evolution of DeFi, regulatory shifts, and the role of NFTs. By the end, you’ll have a clear picture of where the crypto space is heading and how to make informed decisions.

Trend 1 — DeFi Expansion Continues

Decentralized Finance (DeFi) is growing beyond Ethereum to multiple blockchains

Lending, borrowing, yield farming, and staking attract retail and institutional investors

Mini-case study: Platforms like Aave, Compound, and Solana-based DeFi protocols are seeing billions in daily transaction volume

Smart contracts automate financial operations, reducing reliance on banks

Investor Insight: DeFi provides both high opportunity and risk, so understanding protocols and audits is key.

Trend 2 — NFTs & Digital Assets Evolve

Non-fungible tokens (NFTs) are becoming more than art: gaming, metaverse, music, and real estate

Layer 2 solutions make NFT transactions faster and cheaper

Example: NFT-based gaming economies and virtual land platforms are creating new revenue streams

Royalties and automated payments via smart contracts benefit creators

Trend 3 — Regulatory Clarity

Governments worldwide are introducing clearer cryptocurrency regulations

SEC, MiCA (EU), and Asian regulators are defining rules for exchanges, stablecoins, and crypto funds

Regulatory clarity encourages institutional adoption and protects retail investors

Pro Tip: Keep updated on local regulations to avoid compliance issues and potential fines.

Trend 4 — Stablecoins & Central Bank Digital Currencies (CBDCs)

Stablecoins provide a bridge between fiat and crypto, supporting DeFi and trading

CBDCs (e.g., Digital Yuan, Digital Euro) are emerging globally

They offer faster settlements, lower transaction costs, and financial inclusion

Trend 5 — Layer 2 & Scalability Solutions

Ethereum Rollups, Polygon, Arbitrum, and Lightning Network improve transaction speed and reduce fees

Enables mass adoption of dApps and NFT marketplaces

Example: Layer 2 solutions on Ethereum process thousands of TPS (transactions per second)

Trend 6 — Emerging Altcoins & Token Innovation

New altcoins with unique use cases gain traction

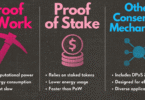

Examples: Polkadot (interoperability), Cardano (eco-friendly PoS), Solana (high-speed transactions)

Utility tokens in DeFi, gaming, and Web3 continue to expand

Investor Insight: Research projects carefully, including team, roadmap, and tokenomics, before investing.

Trend 7 — Blockchain Interoperability

Multi-chain ecosystems allow assets and data to move across blockchains seamlessly

Cross-chain bridges improve liquidity and dApp integration

Example: Cosmos and Polkadot connect diverse networks for global adoption

Trend 8 — AI & Blockchain Integration

AI enhances crypto trading, security monitoring, fraud detection, and predictive analytics

DeFi protocols increasingly use AI to optimize yield farming and lending

Example: AI-driven trading bots analyze blockchain data in real time

Trend 9 — Institutional Adoption

Major companies and funds continue investing in crypto

Examples: Tesla, MicroStrategy, BlackRock, and Fidelity expanding crypto holdings

Institutional involvement brings liquidity, stability, and market maturity

Trend 10 — Security & Cybersecurity Focus

As crypto adoption grows, security becomes critical

Audited smart contracts, multi-signature wallets, cold storage, and anti-phishing measures are essential

Mini-case study: Protocols with regular audits avoid hacks and build trust

FAQs

Q1: What are the top cryptocurrency trends in 2025?

A: DeFi expansion, NFT evolution, regulatory clarity, stablecoins/CBDCs, Layer 2 solutions, emerging altcoins, interoperability, AI integration, institutional adoption, and enhanced security.

Q2: How is DeFi evolving?

A: DeFi is expanding across multiple blockchains, offering lending, borrowing, and yield farming with smart contract automation.

Q3: Are NFTs still relevant?

A: Yes, NFTs are expanding into gaming, metaverse, music, and real estate, providing new revenue streams.

Q4: Why is regulatory clarity important?

A: Clear regulations protect investors, encourage institutional adoption, and reduce legal risks.

Q5: What role do Layer 2 solutions play?

A: They improve scalability, reduce transaction fees, and enable mass adoption of dApps and NFTs.

Q6: How is AI integrated with blockchain?

A: AI assists in trading, security, fraud detection, predictive analytics, and optimizing DeFi protocols.

Internal Links

Blockchain Technology Explained: How It Works & Key Use Cases in 2025

DeFi Explained: Opportunities & Risks in 2025

Web3 & Decentralization: The Future of the Internet

External Links

CoinDesk Cryptocurrency News

Investopedia: Cryptocurrency Trends

Ethereum.org Layer 2 Solutions