INTRODUCTION

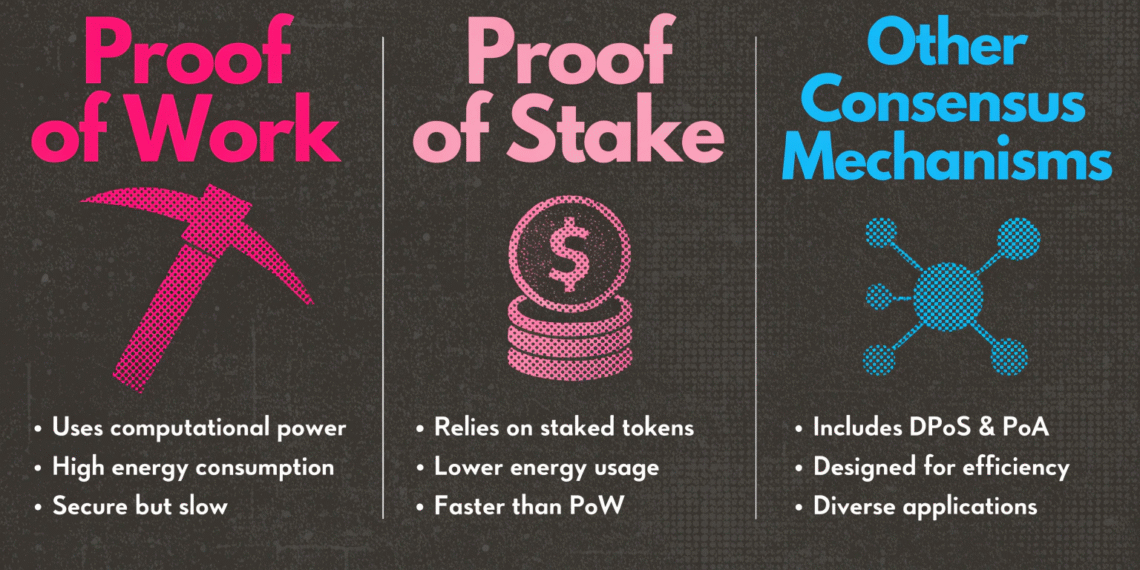

Consensus mechanisms are the heart of blockchain technology, determining how transactions are verified, blocks are added, and the network remains secure. In 2025, as blockchain adoption expands across industries, understanding PoW, PoS, and alternative mechanisms is crucial for developers, investors, and crypto enthusiasts.

From my experience studying blockchain networks, these mechanisms not only ensure security and decentralization but also influence energy consumption, scalability, and participation incentives.

In this guide, we’ll explore the most widely used consensus mechanisms, explain how they work, compare their advantages and drawbacks, and examine their real-world applications. By the end, you’ll understand which mechanism suits different blockchain networks and why they are critical for trustless systems.

What Are Consensus Mechanisms?

A consensus mechanism is a protocol that allows blockchain nodes to agree on a single version of the truth without relying on a central authority.

Key purposes:

Validate transactions

Secure the network against attacks

Ensure trust among decentralized participants

Investor Insight: Consensus mechanisms are what make decentralized networks trustworthy and resilient against malicious actors.

Proof of Work (PoW)

How PoW Works

Miners compete to solve cryptographic puzzles

First miner to solve it adds a new block to the blockchain

Rewards are given in the network’s native cryptocurrency

Example: Bitcoin and Litecoin use PoW.

Advantages of PoW

Highly secure due to computational difficulty

Proven and time-tested (Bitcoin has run on PoW since 2009)

Drawbacks of PoW

High energy consumption

Requires expensive hardware (ASICs)

Slower transaction processing compared to PoS

Mini-case study: Bitcoin’s PoW network consumes energy comparable to a small country, sparking debates about sustainability.

Proof of Stake (PoS)

How PoS Works

Validators are chosen to create new blocks based on the number of coins they stake

Staked coins act as collateral against dishonest behavior

Example: Ethereum 2.0, Cardano

Advantages of PoS

Energy-efficient compared to PoW

Encourages network participation via staking rewards

Faster transaction processing

Drawbacks of PoS

Wealth concentration risk (those with more coins have more influence)

Requires reliable node operation to avoid penalties

Investor Insight: PoS makes blockchain eco-friendly and scalable while maintaining security.

Delegated Proof of Stake (DPoS)

How DPoS Works

Coin holders vote for delegates to validate transactions

Delegates produce blocks on behalf of the network

Example: EOS, Tron

Advantages of DPoS

Extremely fast transaction processing

Lower energy usage than PoW

Community-driven governance

Drawbacks of DPoS

Centralization risk if few delegates dominate

Vulnerable to collusion among delegates

Other Consensus Mechanisms

Proof of Authority (PoA): Trusted validators verify transactions; used in private blockchains

Proof of Burn (PoB): Miners “burn” coins to gain the right to mine

Hybrid Mechanisms: Combine PoW and PoS for security and efficiency

Pro Tip: Different mechanisms suit different networks — PoW for maximum security, PoS for energy efficiency, PoA for enterprise blockchains.

Comparing Consensus Mechanisms

| Mechanism | Security | Energy Efficiency | Decentralization | Speed | Use Case |

| PoW | High | Low | High | Medium | Bitcoin, Litecoin |

| PoS | Medium-High | High | Medium | Fast | Ethereum 2.0, Cardano |

| DPoS | Medium | High | Medium-Low | Very Fast | EOS, Tron |

| PoA | Medium | Very High | Low | Very Fast | Enterprise/Private |

Investor Insight: Understanding the trade-offs helps in choosing networks to invest in or develop on.

Real-World Applications in 2025

Bitcoin: Secure digital gold using PoW

Ethereum 2.0: Decentralized apps with PoS

EOS/Tron: High-speed dApps using DPoS

Private Blockchains: Supply chain, healthcare, and enterprise systems using PoA

Mini-case study: Supply chain networks often use PoA for controlled access, while public finance apps rely on PoS for energy efficiency and scalability.

FAQs (Schema-Ready)

Q1: What is a blockchain consensus mechanism?

A: It’s a protocol that allows all nodes in a network to agree on a single version of the blockchain, ensuring security and trust.

Q2: What is the difference between PoW and PoS?

A: PoW uses computational work to validate blocks, consuming high energy, while PoS uses staked coins and is more energy-efficient.

Q3: What is DPoS?

A: Delegated Proof of Stake allows coin holders to vote for delegates who validate transactions on their behalf.

Q4: Which consensus mechanism is most secure?

A: PoW is highly secure due to computational difficulty, but PoS and DPoS are secure when properly implemented.

Q5: Can private blockchains use these mechanisms?

A: Private blockchains often use PoA or hybrid models optimized for speed and controlled access.

Q6: How do consensus mechanisms affect scalability?

A: Mechanisms like PoS and DPoS are faster and more scalable, while PoW is slower but highly secure.

Internal Links

Blockchain Technology Explained: How It Works & Key Use Cases in 2025

DeFi Explained: Opportunities & Risks in 2025

Web3 & Decentralization: The Future of the Internet

External Links (High Authority)