Introduction

DeFi Growth 2025 is transforming the financial landscape by offering decentralized lending, borrowing, staking, and trading across multiple blockchain platforms without traditional intermediaries. With billions in total value locked (TVL), DeFi continues to drive blockchain adoption and financial innovation.

From my experience analyzing DeFi projects, success depends on understanding protocols, smart contracts, risks, and emerging platforms. While DeFi offers high returns and innovative financial solutions, it also comes with smart contract vulnerabilities, regulatory scrutiny, and market volatility.

In this guide, we’ll explore the current state of DeFi in 2025, highlight opportunities and risks, review emerging platforms, and provide practical tips for users and investors. By the end, you’ll have a comprehensive understanding of the DeFi ecosystem and how to participate safely and strategically.

DeFi Market Overview in 2025 DeFi Growth

Total Value Locked (TVL) surpassed $250 billion in early 2025

Multi-chain DeFi adoption expands beyond Ethereum to Solana, Avalanche, and Polygon

Key sectors: lending, borrowing, decentralized exchanges (DEXs), staking, and derivatives

Example: Aave and Compound maintain leadership in lending and borrowing

Investor Insight: TVL growth indicates both adoption and liquidity in the ecosystem.

Key Opportunities in DeFi

- Lending & Borrowing

Peer-to-peer lending without intermediaries

Users can earn interest by lending crypto assets

Example: Aave allows borrowers to access funds with variable or stable interest rates

- Yield Farming & Staking

Provide liquidity to protocols in exchange for rewards

High returns possible but with smart contract and impermanent loss risks

Example: Liquidity pools on Uniswap, PancakeSwap, and Curve

- Decentralized Exchanges (DEXs)

Trade cryptocurrencies without centralized exchanges

Lower fees, faster transactions, and global access

Example: Uniswap, SushiSwap, and Raydium

- Tokenized Assets & Synthetic Products

Trade real-world assets like stocks, commodities, or indices as blockchain tokens

Expands DeFi opportunities and liquidity

Example: Synthetix allows synthetic exposure to real-world assets

Risks in DeFi

Smart Contract Vulnerabilities: Bugs or exploits can lead to fund loss

Impermanent Loss: Losses in liquidity provision due to price fluctuations

Regulatory Uncertainty: Compliance with KYC/AML regulations may affect access

Market Volatility: High fluctuations can affect yield and collateral value

Tip: Only invest what you can afford to lose and diversify across protocols.

Emerging DeFi Platforms in 2025

Aave: Lending and borrowing on multiple chains

Compound: Flexible lending rates and cross-chain integrations

Uniswap & SushiSwap: Leading decentralized exchanges

Curve & Balancer: Stablecoin-focused liquidity solutions

Layer 2 DeFi: Platforms on Polygon, Arbitrum, and Optimism reduce fees and improve transaction speed

Mini-case study: Solana-based DeFi protocols have seen rapid adoption due to low fees and high-speed transactions, attracting both retail and institutional users.

Strategies for Participating in DeFi

Conduct thorough research on protocols and audits

Diversify across lending, staking, and DEX participation

Use hardware wallets or secure platforms for transactions

Monitor TVL, APY, and platform reputation

Stay updated on regulatory developments to ensure compliance

DeFi Trends to Watch in 2025

Cross-chain Interoperability: Seamless asset transfers between chains

AI-Driven Yield Optimization: Automated strategies for higher returns

NFT & DeFi Integration: Using NFTs as collateral or liquidity

Institutional Participation: Large funds entering DeFi markets

Regulatory Compliance: Growing importance of KYC/AML frameworks

FAQs

Q1: What is DeFi and why is it growing in 2025?

A: DeFi is decentralized finance, offering lending, borrowing, staking, and trading without intermediaries. Growth is driven by increased adoption, liquidity, and multi-chain expansion.

Q2: What are the key risks in DeFi?

A: Smart contract vulnerabilities, impermanent loss, market volatility, and regulatory uncertainty.

Q3: Which DeFi platforms are emerging in 2025?

A: Aave, Compound, Uniswap, SushiSwap, Curve, Balancer, and Layer 2 DeFi solutions on Polygon, Arbitrum, and Optimism.

Q4: How can investors participate safely in DeFi?

A: Research protocols, diversify investments, use secure wallets, monitor APY and TVL, and stay informed about regulations.

Q5: What are the opportunities in DeFi?

A: Lending, borrowing, yield farming, staking, trading on DEXs, and tokenized asset exposure.

Q6: How is DeFi integrating with other blockchain sectors?

A: NFTs, cross-chain solutions, AI-driven optimization, and institutional adoption are enhancing the ecosystem.

Internal Links

Top Cryptocurrency Trends to Watch in 2025

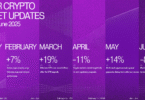

Major Cryptocurrency Market Updates: January–June 2025

How Cryptocurrency Regulations Are Shaping the Market in 2025

External Links

CoinDesk DeFi News

Investopedia: DeFi Overview

Ethereum.org DeFi Resources