Introduction

Decentralized Finance (DeFi) is reshaping the financial ecosystem by enabling peer-to-peer lending, borrowing, staking, yield farming, and decentralized trading. With the market expanding in 2025, several DeFi platforms have emerged as leaders, offering high returns, multi-chain access, and innovative financial tools.

From my experience exploring DeFi, the key to success is understanding platform functionality, benefits, risks, and user experience. Choosing the right platform allows users to maximize returns while minimizing risks associated with smart contracts, market volatility, and regulatory uncertainty.

In this guide, we’ll explore the top DeFi platforms in 2025, break down their features and benefits, and provide practical steps to get started. By the end, you’ll have a roadmap to participate in DeFi safely and effectively.

Leading DeFi Platforms in 2025

- Aave

Features: Lending and borrowing, flash loans, multi-chain support

Benefits: High liquidity, flexible interest rates, support for Layer 2 solutions

Getting Started: Connect a Web3 wallet, deposit crypto to start earning interest

Mini-case study: Polygon integration reduced gas fees, attracting more retail users

- Compound

Features: Algorithmic interest rates, collateralized loans, cross-chain support

Benefits: Transparent governance, predictable yields for stablecoins

Getting Started: Deposit crypto, receive cTokens representing your stake, and start earning

- MakerDAO

Features: Collateralized DAI loans, decentralized governance

Benefits: Stablecoin borrowing, transparent smart contracts

Getting Started: Lock collateral (e.g., ETH), mint DAI, and manage risk through liquidation thresholds

- Uniswap

Features: Decentralized exchange (DEX), liquidity pools, token swaps

Benefits: Low fees, instant token swaps, liquidity provider rewards

Getting Started: Connect a Web3 wallet, swap tokens or provide liquidity to earn fees

- Curve Finance

Features: Stablecoin-focused DEX, low slippage, yield farming integration

Benefits: Efficient stablecoin swaps, high liquidity, reliable returns

Getting Started: Deposit stablecoins into liquidity pools to earn CRV rewards

- Lido Finance

Features: Liquid staking for ETH and other tokens

Benefits: Earn staking rewards while retaining liquidity

Getting Started: Stake tokens via Lido, receive stTokens to use in other DeFi protocols

Key Features to Look for in DeFi Platforms

Security: Audits, smart contract reliability, and insurance coverage

Liquidity: Higher TVL ensures smoother transactions

Fees: Low transaction and platform fees for cost-effective participation

Governance: Decentralized governance allows community voting and transparency

User Experience: Easy wallet integration, intuitive interface, and accessible guides

Benefits of Using DeFi Platforms

Passive Income: Earn interest through lending or staking

Access to Liquidity: Borrow funds without selling assets

Decentralized Control: No intermediaries controlling funds

High-Yield Opportunities: Yield farming and liquidity mining rewards

Multi-Chain Access: Participate across Ethereum, Polygon, Solana, Avalanche, and other networks

Risks & Safety Measures

Smart Contract Vulnerabilities: Use audited platforms

Market Volatility: Stablecoins reduce exposure to price swings

Collateral Liquidation: Over-collateralize to prevent forced liquidation

Platform Risk: Prefer well-established and regulated platforms

Tip: Combine diversification, small allocations, and research to mitigate risks.

Step-by-Step Guide to Getting Started on DeFi

Set Up a Web3 Wallet: MetaMask, Coinbase Wallet, or Trust Wallet

Deposit Funds: Transfer ETH, USDC, or other supported tokens

Select a Platform: Choose based on your goals (lending, borrowing, trading, staking)

Connect Wallet to Platform: Authorize transactions securely

Start Earning or Borrowing: Deposit assets, earn interest, or borrow with collateral

Monitor Performance: Track APY, TVL, and collateral ratios regularly

Emerging Trends in 2025

Layer 2 Integration: Faster, cheaper transactions

NFT Collateral Loans: Borrowing against NFTs

Cross-Chain DeFi: Seamless asset transfers between blockchains

AI-Powered Strategies: Automated yield optimization

Institutional Participation: Increasing liquidity and market stability

FAQs

Q1: Which are the top DeFi platforms in 2025?

A: Aave, Compound, MakerDAO, Uniswap, Curve, and Lido Finance are among the leading platforms.

Q2: How do I get started on DeFi platforms?

A: Set up a Web3 wallet, deposit funds, select a platform, connect your wallet, and start lending, borrowing, or staking.

Q3: What are the main risks of DeFi participation?

A: Smart contract vulnerabilities, market volatility, collateral liquidation, and platform risk.

Q4: How can I minimize DeFi risks?

A: Use reputable platforms, diversify, over-collateralize loans, and monitor performance regularly.

Q5: What are the benefits of DeFi platforms?

A: Passive income, liquidity access, decentralized control, high-yield opportunities, and multi-chain participation.

Q6: Are there new trends in DeFi for 2025?

A: Yes, including Layer 2 adoption, NFT collateral loans, cross-chain solutions, AI-powered strategies, and institutional involvement.

Internal Links

DeFi Lending & Borrowing Explained: A 2025 Guide

Top Cryptocurrency Trends to Watch in 2025

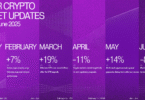

Major Cryptocurrency Market Updates: January–June 2025

External Links

Aave Official Site

Compound Finance

MakerDAO

Ethereum.org DeFi Resources