Introduction

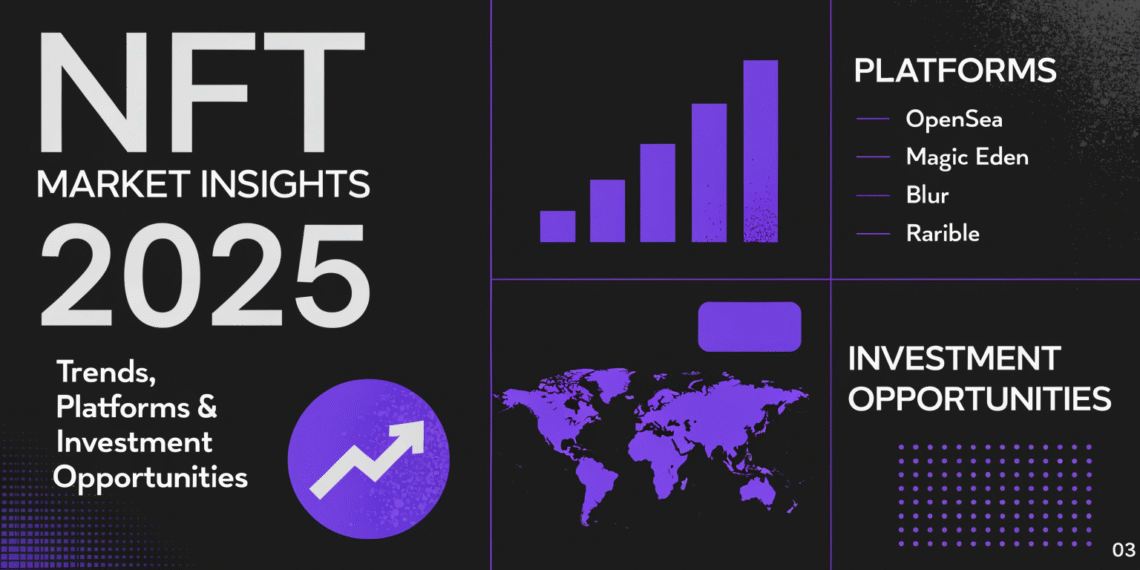

NFT Market Insights 2025 reveal how non-fungible tokens are transforming digital ownership, gaming, art, music, virtual real estate, and the metaverse. With NFTs becoming a multibillion-dollar asset class, understanding trends, platforms, and investment opportunities is essential for creators, collectors, and investors.

From my experience observing NFT adoption, success in this space depends on tracking market trends, evaluating platforms, and recognizing risks associated with digital ownership. NFTs now provide ways to earn royalties, engage communities, and access new markets while offering potential long-term returns.

In this guide, we’ll explore the current NFT market trends, popular platforms, and investment opportunities in 2025, providing strategies and insights to safely navigate this rapidly growing ecosystem.

Current NFT Market Overview NFT Market Insights

Global NFT market value exceeds $40 billion in 2025

Major sectors: digital art, gaming, metaverse real estate, music, and collectibles

Platforms support secondary markets and royalty automation via smart contracts

Example: OpenSea, Rarible, and Magic Eden lead in trading volume

Investor Insight: Understanding market size and sectors helps identify high-potential NFTs.

Key NFT Market Trends in 2025

- Gaming & Metaverse Integration

Play-to-earn and virtual worlds dominate NFT use

NFT-based in-game assets offer real ownership and trading opportunities

Example: Decentraland, The Sandbox, and Axie Infinity

- Music, Art & Creator Economy

Artists and musicians tokenize their work for royalties and community engagement

Fractional ownership allows multiple investors to co-own high-value NFTs

Platforms: Audius (music NFTs), SuperRare (art NFTs)

- Layer 2 & Cross-Chain Adoption

Faster, cheaper NFT transactions on Layer 2 solutions like Polygon and Arbitrum

Interoperability enables NFTs to move across different blockchains

- NFT Fractionalization

High-value NFTs can be split into multiple tokens for wider investor access

Increases liquidity and trading volume

Example: Fractional.art and Unic.ly

- Institutional Interest & Investment

Venture funds and corporate treasuries invest in NFT collections

NFTs increasingly considered as alternative digital assets

Example: Sotheby’s and Christie’s auction NFT art

Popular NFT Platforms in 2025

OpenSea: Leading marketplace for collectibles and art

Rarible: Decentralized platform supporting creators and royalties

Magic Eden: Solana-based NFT marketplace

SuperRare: Exclusive digital art marketplace

Fractional.art: Facilitates fractional ownership of high-value NFTs

Mini-case study: Layer 2 NFT platforms have reduced transaction costs, enabling higher trading frequency and adoption among retail investors.

NFT Investment Opportunities

Digital Art: High potential for appreciation and royalties

Gaming Assets: Virtual items and characters for play-to-earn economies

Metaverse Real Estate: Virtual land and properties with growing demand

Music NFTs: Tokenized music tracks and royalties for long-term passive income

Fractionalized NFTs: Diversified exposure to high-value digital assets

Investor Tip: Evaluate creator credibility, platform security, and liquidity before investing.

Risks in NFT Investments

Market Volatility: NFT prices can fluctuate widely

Liquidity Risk: Some NFTs may be hard to sell quickly

Fraud & Scams: Fake NFTs or unverified projects

Regulatory Uncertainty: Future rules may impact NFT ownership or trading

Pro Tip: Only invest what you can afford to lose and conduct thorough due diligence.

Strategies for NFT Success

Research creators, platforms, and community engagement

Diversify across sectors: art, gaming, metaverse, music

Use secure wallets and verify authenticity

Track market trends and Layer 2 adoption

Consider fractional ownership for high-value NFTs

FAQs

Q1: What are the key NFT trends in 2025?

A: Gaming/metaverse integration, creator economy, Layer 2 adoption, fractionalization, and institutional investment.

Q2: Which platforms dominate the NFT market?

A: OpenSea, Rarible, Magic Eden, SuperRare, and Fractional.art are key platforms.

Q3: What are NFT investment opportunities?

A: Digital art, gaming assets, metaverse real estate, music NFTs, and fractionalized NFTs.

Q4: What are the main risks of investing in NFTs?

A: Market volatility, liquidity issues, scams, and regulatory uncertainty.

Q5: How can investors participate safely?

A: Conduct research, diversify, use secure wallets, and stay updated on trends.

Q6: What is fractionalized NFT ownership?

A: Splitting high-value NFTs into multiple tokens, allowing multiple investors to own a portion and improving liquidity.

Internal Links

Top Cryptocurrency Trends to Watch in 2025

DeFi Growth in 2025: Opportunities, Risks & Emerging Platforms

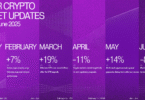

Major Cryptocurrency Market Updates: January–June 2025

External Links

OpenSea NFT Marketplace

Investopedia NFT Guide

Ethereum.org NFT Resources